Challenges

To address these issues and enable system-wide optimization, the retailer partnered with Trinamix to implement Investment Buy, an AI-driven procurement optimization engine tightly integrated with Oracle Supply Planning Cloud and Procurement Cloud. Leveraging stochastic modeling and NSGA-II (a non-dominated sorting genetic algorithm), the solution optimizes purchases based on multiple constraints—shelf life, storage capacity, cumulative tiered pricing, and multi-unit truckload optimization (volume, weight, pallet space). It also factors in supplier commitments, buyback clauses, and opportunity buys from internal tools like E-Deals.

About the Company

- Industry: CPG/Retail

- Employees: Over 200,000

- Number of Stores: 2000+ retail food and drug stores

- Market Share: Estimated at 9.4% in the U.S. grocery sector

Approach

Project Objectives

- Data-Driven Procurement Decisions: Leverage data from ERP, Supply Planning, Pricing Terms, Shelf-Life, DC Inventory, and Promotions to enable holistic, data-driven procurement decisions.

- Enhanced Visibility and Supplier Collaboration: Improve transparency and responsiveness across the entire Purchase Order (PO) lifecycle—from PO generation through acknowledgments, ASN submissions, and in-transit tracking—to ensure timely material receipt.

- Strategic Investment Buying: Utilize Trinamix’s industry solution, Investment Buy, to execute forward-looking purchases that secure optimal pricing and mitigate future cost increases.

- AI-Driven Optimization: Apply simulation and AI-based algorithms to dynamically calculate EOQ (Economic Order Quantity), MOQ (Minimum Order Quantity), and FLM (Forward Looking Minimums) for each SKU-DC pairing.

- Operational Constraints Modeling: Integrate complex constraints such as vendor packaging requirements, truckload capacity, and warehouse storage limitations to drive feasible procurement decisions.

- Working Capital Optimization: Identify and act on smart buying opportunities to reduce excess inventory and optimize capital utilization.

- Scenario Planning and Simulation tools: Empower procurement teams with the ability to evaluate multiple investment scenarios and make informed, AI-guided buying decisions through advanced simulation capabilities.

- Supplier Self-Service Portal: Enable suppliers to access a unified platform for viewing and managing procurement activities, fostering self-sufficiency and efficiency.

- Collaborative Procurement Ecosystem: Establish a shared collaboration platform between the supplier network and internal procurement teams to streamline communication and decision-making.

Project Highlights

- Seamless Data Unification: Integrated internal and external data sources into Oracle Cloud, enabling a holistic view of supply and demand signals.

- Investment Buy Optimization Engine: Customized and deployed Trinamix's Investment Buy solution using stochastic modeling (NSGA-II algorithm) to recommend optimal buy quantities, factoring in EOQ, shelf-life, demand variability, and cost structures.

- Advanced Simulation Capabilities: Developed a simulation workbench allowing planners to test changes in capacity, opportunity mix, and demand inputs—enabling visibility into SKU-level impact, PO cancellations, and cost implications.

- Tiered Pricing and Opportunity Modeling: Enabled optimization of complex tiered supplier offers across multiple items, leveraging weight, volume, and dollar thresholds to maximize supplier discounts and ROI.

- Supplier Forecast Collaboration: Facilitated collaboration with suppliers on forecast sharing and commitment planning across time horizons, including constraints like lead times and cycle times.

- Truckload and Logistics Optimization: Introduced supplier clustering and truckload consolidation logic to minimize logistics costs while honoring vendor min/max constraints and maximizing vehicle utilization.

- Integration Across Oracle cloud Modules: Achieved tight integration with Oracle Supply Planning Cloud and Procurement Cloud; enabled automated requisition creation based on optimized buy plans.

- Advanced Stochastic Modeling: Applied advanced stochastic techniques using demand error patterns, plan orders, and real-time constraints to simulate and optimize investment buying decisions.

- User-Controlled Scenario Planning: Provided planners with manual overrides and what-if simulations (e.g., changing working capital or item quantities) to assess financial and operational impacts.

- Cross-System Integration: Integrated with WMS for storage constraints, E-Deals for supplier opportunities, and Oracle Procurement Cloud for BPA and tiered pricing data.

- Targeted Inventory Reduction: Solution aimed at optimizing over $700 million in inventory with an expected reduction of ~10%, significantly improving working capital and reducing wastage of perishables.

- Support for Multi-Unit Constraints: Handled buying and logistics decisions based on volume, weight, pallets, and dollar-value—accounting for various unit-of-measure constraints across the supply chain.

- Industry Relevant Innovation: Designed with grocers and food distributors in mind, but adaptable for logistics-intensive industries, such as furniture and general distribution.

Results

- 40–70% waste reduction: By optimizing EOQ for perishables based on their declining purchase likelihood over time, retailers have reduced waste by up to 70%, unlocking $30 million in working capital savings.

- 18–24% productivity gains: Improved buying decision workflows validated through UAT have increased productivity by up to 24%, paving the way for resource reallocation and potential reduction in buyer headcount (currently at 900).

- $28–60 million cost savings via AI-Driven Promotions: Using advanced stochastic AI models, the solution identifies optimal promotion opportunities within budget constraints—leading to substantial savings.

- $12–18 million in logistics cost reduction: Enhanced truckload consolidation has the potential to significantly reduce logistics spend for retailers, with the added benefit of lower CO2 emissions.

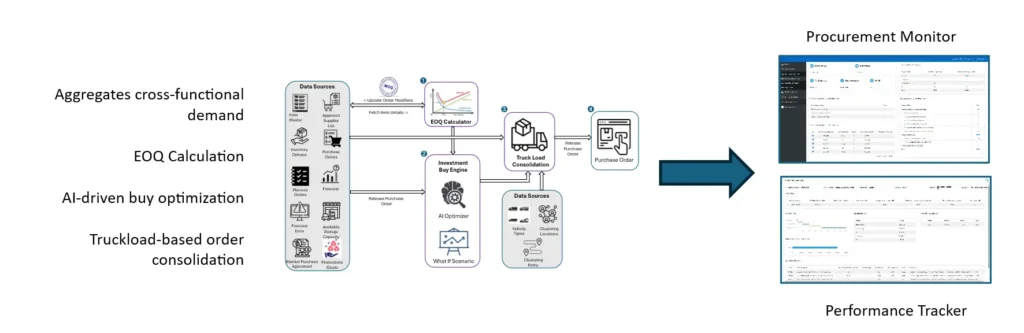

Solution Architecture

How Trinamix Investment Buy Works

Extensive user acceptance testing confirmed the solution’s usability and functional robustness, with minimal post-launch adjustments required—underscoring the stability of the design. Early pilot results forecast an 8–10% inventory reduction, translating into substantial cost savings and improved working capital efficiency.

- Understands Shelf Life: Prevents overbuying products that will expire before you can sell them.

- Checks Budget Limits: Ensures your funds are spread smartly across essential items — not just bulk discounts.

- Accounts for Warehouse Space: Doesn’t suggest buying more than you can store.

- Plans for Price Increases: Recommends early buys before known supplier price hikes.

- Handles Tiered Discounts: Suggests the right quantity where the discount is worth it — without overstocking.

- Targets Volume Bonuses: Helps you meet lump sum thresholds (like “spend X to get Y% off”) by optimizing your overall mix.

- Optimizes Truckloads: Groups purchases to fill transport vehicles efficiently, reducing shipping costs.

- 20% Discount: If you buy 1,000 packets of milk

- 30% Discount: If you buy 2,000 packets of milk

The product expires quickly.

You don’t have enough warehouse space.

Your budget is limited.

Future demand is uncertain.

Trinamix Investment Buy considers this real-world challenge. It calculates how much milk you can sell within the shelf life and recommends buying only what makes sense — balancing discounts with real demand and storage capacity.

- 40% discount if you buy 1 truckload of flour bags

- 50% discount if you buy 2 truckloads

- Warehouse Limitation: You only have space for half a truckload.

- Budget Constraint: You need to purchase other essentials too — not just flour bags.

- Product Stability: Though flour bags have a longer shelf life than milk, it still needs to move quickly to prevent backlog or infestation.

- Buying only half a truckload, even if it means skipping the 50% discount — because you avoid overbuying, preserve budget for other products, and eliminate the risk of unused inventory.

The outcome

Proven Results – Step-by-Step Progress with Tangible Outcomes

5% – Executive Briefing

Gain detailed insights into Trinamix's capabilities, Investment Buy best practices, and highest-value use cases.

10% – Technology Assessment

Dive into the Trinamix platform's capabilities, its model-driven architecture, and test it against your company's sample data set.

35% – Product Trial

Identify a high-impact business problem and collaborate with the Trinamix team to rapidly build an application that solves it.

50% – Application Development in Production

Scale and deploy a tested Trinamix application into production. Incorporate user feedback and optimize algorithms to drive maximum economic value.