Oracle Tax Reporting Cloud

It is a powerful and simple tool which quickly navigates to the operational dashboards, national and regional tax packages and country by country reports. The dashboard gives an overview of tasks that are late, open and completed. This solution also provides an interactive bar and pie charts for reporting. On the compliance dashboard, the user can see more details about the tax close completion process. Oracle Tax Reporting Cloud enables you to calculate, report on, and approve current and deferred taxes at the national and regional level. Perform effective tax planning with accurate analysis of financial data. Key features of this solution help you to generate, analyze, and approve current and future tax requirements with accountability and insights across your global enterprise.

Out-of-the-box tax reporting

Improvement in tax process

Transparency between tax and finance

Easy adoptation

Success stories

Why Trinamix

Our Offerings

You may also like

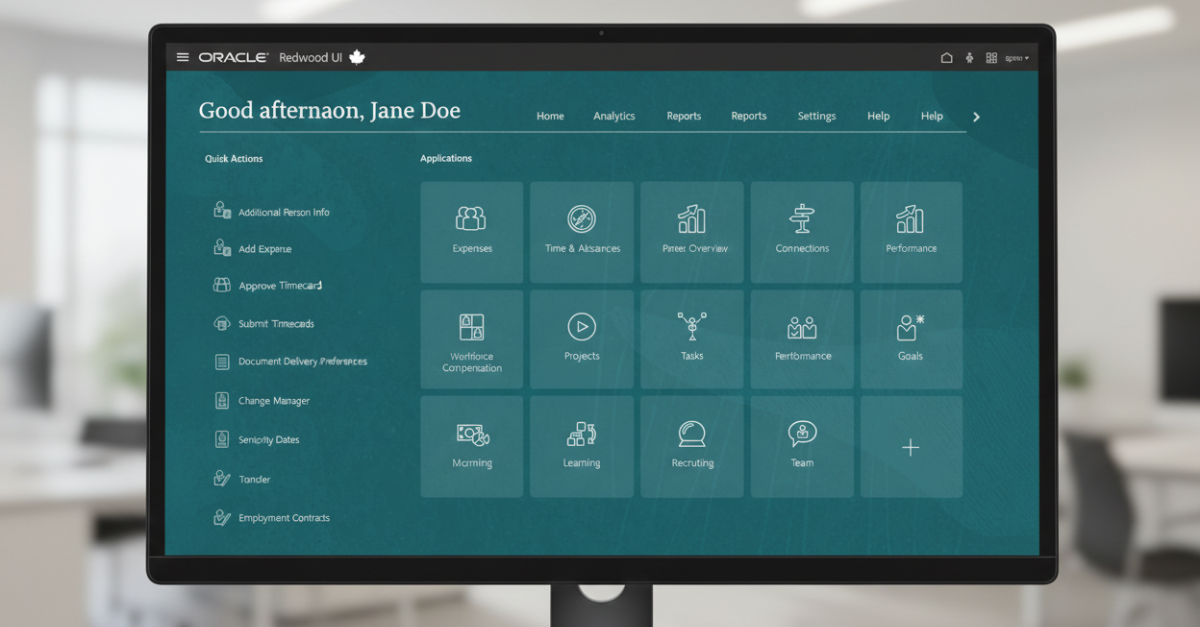

Redwood UI – How It’s Changing and How It Differs from the Previous UI

User experience is no longer just about navigation and screen layouts—it’s about

Understanding Generative AI: What it is and how it works

In today’s fast-evolving digital landscape, Generative AI (GenAI) is no longer just

Inside Oracle AI World 2025: Trinamix Highlights and Takeaways from a Game-Changing Week in AI

Oracle AI World 2025 marked an exciting milestone in Trinamix’s journey to

Extending Oracle Smart Operations: The Emerging Patterns of Cloud MES Adoption

Extending Oracle Smart Operations to Meet Industry-Specific Needs As we continue our