In today’s fast-paced business environment, marked by growing financial intricacies, organizations are

seeking a comprehensive solution to streamline and optimize their financial operations. Oracle Fusion

Cloud Financials equips your finance team with advanced data, facilitating enhanced forecasting

accuracy, shortened reporting schedules, streamlined decision-making processes, and more effective

management of risk and compliance.

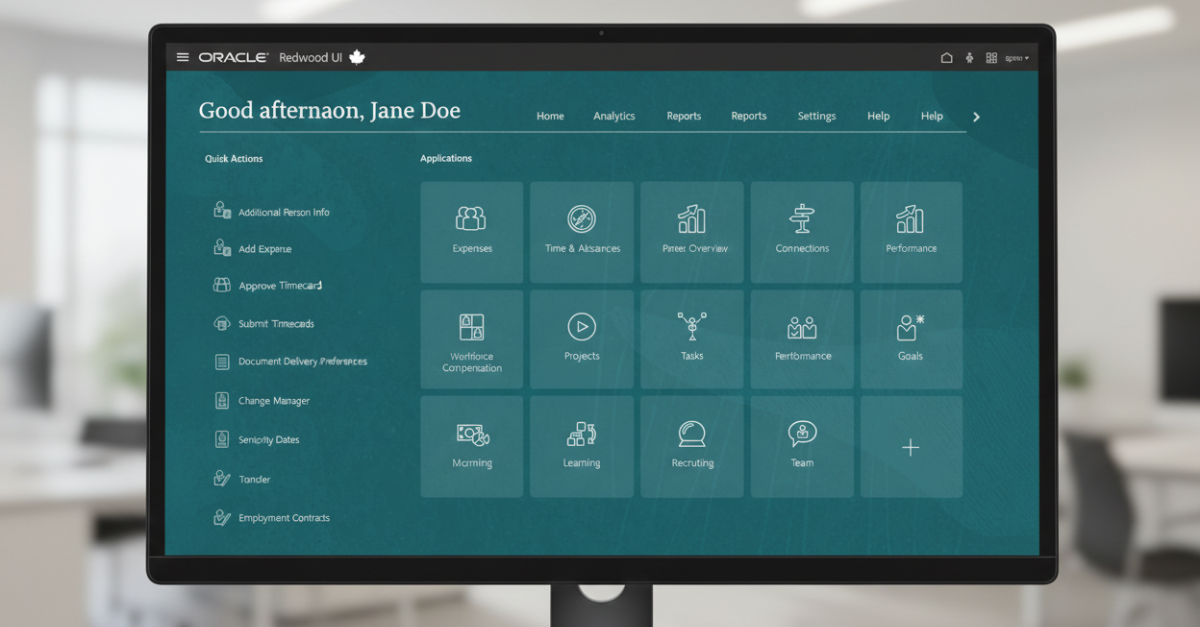

As an advanced financial application, it seamlessly connects and automates various financial

management processes such as payables, receivables, fixed assets, expenses, and reporting, providing

a comprehensive overview of your financial health.

Here’s a list of the top 9 benefits of Oracle Fusion Cloud Financials, how it can help your businesses,

and why companies decide to use it:

1. Resolve issues promptly to expedite automated processing

Speed up accounts payable invoice entry,

minimize errors, and reduce invoice

processing costs with integrated imaging

capabilities while reducing the need for

costly third-party solutions.

2. Enhance decision-making and increase accuracy during transaction entry processing

Support robust, adaptable operations by capturing transactions with greater efficiency while reducing costs for resourceintensive tasks without compromising controls.

3. Better control costs and improve visibility into spending

Utilize budgetary control and encumbrance accounting to control, and monitor spending by checking and reserving funds during transaction entry, seamlessly integrating general ledger data for extended planning and budgeting. Government implementations generally utilize this, whereas, in the private sector, only budgetary controls are employed to monitor actual results against budgets.

4. Gain real-time access to live financial data

Provide a graphical representation of the account balance using visualization tools to simplify financial data analysis, identify potential issues, and make effective business decisions, thereby helping analyze the financials directly in spreadsheets with drilldown capabilities.

5. Increase cash inflows and manage cash positions

Leverage cash management to analyze cash positions and forecast cash requirements through configurable dashboards, work areas, and reports, ensuring liquidity and maximizing the optimal use of cash resources.

6. Decrease data entry errors and transaction processing costs

Extensive spreadsheet integration across multiple finance functions enables highvolume data entry and one-click uploads, making it easy to export reports and transactional tables for further analysis in Excel.

7. Address global accounting standards along with multiple legislative, industry, and geographic requirements

Meet accounting standards such as IFRS 16 and ASC 842 for lease accounting through a comprehensive offering for improving internal controls, standardizing corporate lease policies, and meeting lease obligations.

8. Meet industry-specific requirements for joint venture management

Provide a solution for managing the terms and conditions of your joint ventures by leveraging rules-based, automatic processes to accurately create joint venture distributions for each partner.

9. Enable touchless invoicing process

Eliminate the time-consuming and errorprone tasks of manual invoice entry and matching by enabling image-based data capture in Payables.

Authors

- Abhishek Mishra, Content Manager, Trinamix

- Govindarajan Sundaramoorthy, Oracle EBS/Cloud ERP Solution Architect, Trinamix

- Sathish Kumar, Senior Principal Consultant,Trinamix